Reducing tax evasion and avoidance

Issue

The vast majority of UK individuals and businesses pay the tax that is due. However, there is a small minority who don't.

This imposes an unfair burden on the honest majority and prevents money from reaching the crucial public services that need it. We want to stop people cheating the tax system and collect more of what's owed.

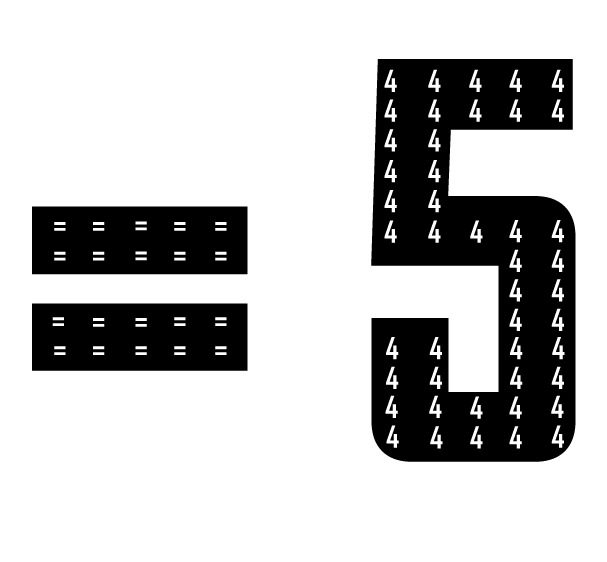

The difference between the revenues that in HM Revenue & Customs' (HMRC) view should come in, and the total actually collected by HMRC, is known as the 'tax gap'. Tax evasion and tax avoidance by businesses and individuals contribute to the tax gap, along with error, failure to take reasonable care, non-payment, legal interpretation, the hidden economy and criminal attacks on the tax system.

The tax gap in the 2010 to 2011 financial year was estimated to be £32 billion – 6.7% of the total tax that HMRC estimates was due – and tax evasion and avoidance together accounted for £9 billion of this.

Actions

We are working to prevent evasion and avoidance, detecting it early where it arises, and counteracting it effectively through investigation and legal challenge.

We are investing in HMRC to prevent tax avoidance and evasion. In 2010 the government allocated HMRC £917 million from efficiency savings to reinvest in generating additional compliance revenues of £7 billion a year by 2015.

In the Chancellor's 2012 Autumn Statement, HMRC received a further £77 million for specific additional projects aimed at reducing evasion and avoidance.

At the G8 summit in June 2013 we announced steps towards achieving greater international tax transparency to prevent offshore tax avoidance and evasion.

Giving people opportunities to declare what they owe

We are running campaigns to encourage people to tell HMRC what they owe, before we track them down. So far, HMRC has raised £547 million from voluntary disclosures, and almost £140 million from follow-up activity including 20,000 completed investigations.

Prosecuting more people who break the law

HMRC is taking swifter legal action against those who don't come forward and sort out their taxes. We are also allocating more resources to increase the pace and number of tax evasion cases being brought before the criminal and civil courts.

We are setting up local task forces to identify and deal with tax cheats, using criminal and civil powers.

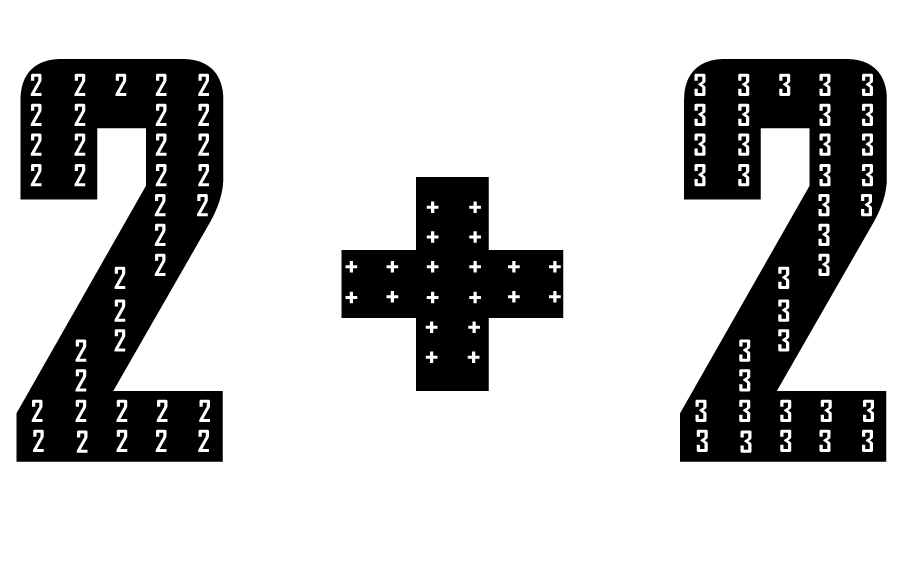

We are prosecuting more people who break the law by evading tax. We have recruited an additional 200 criminal investigators to increase the number of people prosecuted for tax evasion from 165 in 2010 to 2011, to 565 in 2012 to 2013, and to 1,165 in 2014 to 2015.

Preventing avoidance by large multinational corporations

Some multinational businesses avoid paying some taxes by shifting profits away from the location where the activities creating those profits take place - this is also known as base erosion and profit shifting (BEPS).

The international corporate tax standards have struggled to keep pace with changes in global business practices, with an increasing share of trade taking place online. International tax standards have remained largely unchanged for over a hundred years - and now need to be updated to prevent gaps from being exploited.

At the G20 meeting of finance ministers in February 2013, Chancellor of the Exchequer George Osborne welcomed the initial report by the international Organisation for Economic Co-operation and Development (OECD) on addressing BEPS as a first step for dealing with profit shifting by multinational corporations.

At the G8 summit in June 2013, G8 leaders called on the OECD to draw up a template for global corporations to report to tax authorities on where they make their profits and pay taxes around the world. This will give tax authorities around the world a new tool against tax avoidance by multinationals.

Alongside these efforts, we are also recruiting more people to speed up HMRC's work to identify risks relating to large businesses. This will help to make sure that multinationals fully declare their UK profits and pay the tax due in the UK.

Preventing avoidance and evasion by wealthy individuals

We are expanding HMRC's Affluent Unit, with 100 extra investigators and extra risk and intelligence staff to identify and deal with avoidance and evasion by the wealthiest individuals.

We are increasing the number of specialist personal tax inspectors to prevent evasion and avoidance of inheritance tax, using offshore trusts, bank accounts and other entities. These specialists will concentrate in particular on the agents and tax intermediaries involved in these activities.

Increasing our ability to identify offshore tax evasion and avoidance

We are working more closely with other tax administrations to prevent offshore evasion.

At the G8 Summit in June 2013, the UK reached a major new agreement with G8 member states to move to establish the automatic exchange of information between tax authorities. G8 countries agreed to work with the OECD to develop a model for this.

This builds on the prior commitment made by France, Germany, Italy, Spain and the UK to pilot the automatic exchange of tax information. This initiative has since been joined by 12 other EU Member States and Mexico and Norway.

The UK Crown Dependencies and Overseas Territories (Guernsey, the Isle of Man, Jersey , the Cayman Islands, Anguilla, Bermuda, the British Virgin Islands, Montserrat, Gibraltar and the Turks and Caicos Islands) have also joined this initiative, agreeing to automatically exchange information about accounts held in those jurisdictions with the UK and others.

We have also set up a new centre of excellence within HMRC to bring together and enhance our expertise in dealing with offshore evasion. The team will look at how HMRC can best use data to identify offshore tax evasion.

Using data and new technology

We are investing in our ability to use data and new and advanced technology to identify fraud and evasion risks. We have already brought in an extra £1.4 billion of tax revenue by investing £45 million in these activities.

We are improving HMRC's CONNECT analytical computer system, so that the department is better able to identify areas of compliance risk. This will allow HMRC to act swiftly in identifying and investigating fraudulent behaviour.

Dealing with tax avoidance schemes

We are designing legislation that minimises the scope for tax avoidance.

The government has introduced a General Anti-Abuse Rule (GAAR), aimed at deterring and preventing artificial and abusive tax avoidance schemes.

We will also introduce new measures to deal with tax advisers who sell contrived and aggressive tax avoidance schemes. The government has announced it will consult on proposals to introduce significant new information disclosure and penalty powers, to make it more difficult for the promoters of abusive schemes to continue to market them in the future.

We are using settlement opportunities to encourage users of avoidance schemes to agree their tax position with us, and investing in additional resource to accelerate litigation for those who do not settle.

We are making better use of anti-avoidance communications to influence the behaviour of taxpayers and promoters of avoidance schemes. We are also improving the quality of information available on avoidance to help taxpayers realise the potential downsides and risks.

Background

The 2010 document 'The Coalition: our programme for government' stated that the government will make every effort to prevent tax avoidance.

As part of Budget 2011 the government published 'Tackling tax avoidance' which set out our anti-avoidance strategy. The 3 principles are:

preventing avoidance at the outset

detecting it early where it persists

counteracting it through legislative change and challenge through litigation

At Budget 2012 (PDF) we announced new guidance on the General Anti-Abuse Rule (GAAR), following recommendations from a report into tax avoidance (PDF) led by Graham Aaronson in 2011. The guidance will come into affect with the Finance Act 2013, due to be published in summer 2013.

In his December 2012 Autumn Statement, the Chancellor of the Exchequer said: 'There are still too many people who illegally evade their taxes, or use aggressive tax avoidance in order not to pay their fair share' and set out the government's commitment to taking action against these people.

In December 2012 we published 'Closing in on tax evasion: HMRC's approach', which sets out our approach to tax evasion in more detail, concentrating particularly on how we will use third party data.

In the 2013 Budget, HMRC published the report 'Levelling the tax playing field' which highlighted the successes HMRC has had in tackling avoidance, evasion, criminal attack and debt since 2010. HMRC also published its offshore evasion strategy 'No safe havens' which sets out HMRC's approach to tackling offshore evasion.

At the G20 meeting of finance ministers in July 2013, Chancellor of the Exchequer George Osborne welcomed the OECD BEPS action plan to address profit shifting by multinational corporations. The action plan includes 15 specific proposals, which will be taken forward over the next two years.

In 2011 to 2012 HMRC brought in a record £16.7 billion of additional revenues from compliance activities. HMRC also protected £2.5 billion of revenue by preventing organised criminal attacks, and defendants were convicted in 85% of criminal cases taken to court.

The difference between tax avoidance and evasion

Tax avoidance is bending the rules of the tax system to gain a tax advantage that Parliament never intended. It often involves contrived, artificial transactions that serve little or no purpose other than to produce a tax advantage. It involves operating within the letter – but not the spirit – of the law. Tax evasion is when people or businesses deliberately do not pay the taxes that they owe and it is illegal.